Although the 2020 presidential campaign has yet to get into full swing, the spotlight on “Medicare for All” is already giving the health care industry hives.

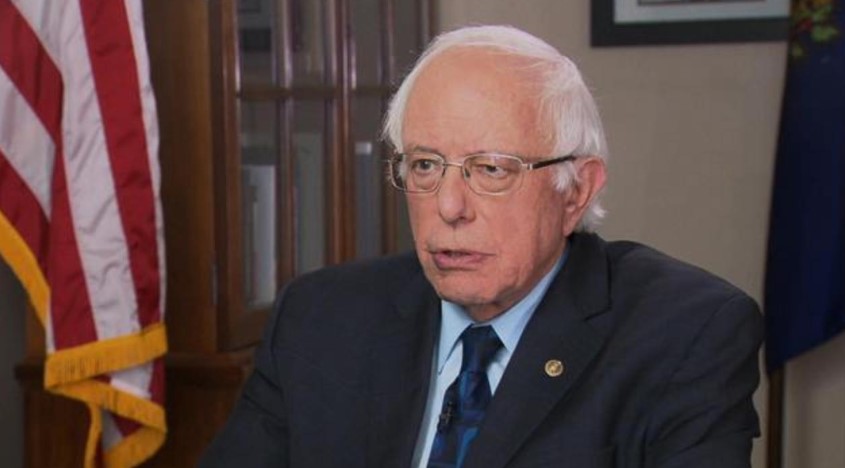

Shares of UnitedHealth, the country’s largest health insurance companies, are slumping after CEO David Wichmann weighed in on the ambitious public health insurance plan backed by Sen. Bernie Sanders and several other Democratic presidential hopefuls as a solution to soaring U.S. medical costs. The insurance executive’s take? Bad idea.

“The wholesale disruption of American health care being discussed in some of these proposals would surely jeopardize the relationship people have with their doctors, destabilize the nation’s health system and limit the ability of clinicians to practice medicine at their best,” he told Wall Street analysts. “And the inherent cost burden would surely have a severe impact on the economy and jobs all without fundamentally increasing access to care.”

Wichmann’s words dragged down UnitedHealth’s stock, which slid 7 percent Tuesday and another 1.8 percent Wednesday. Other health care players, including Anthem, Cigna and HCA Healthcare, also seemed to catch cold. The market value of insurers and hospitals sank a total of $28 billion on Tuesday, according to Bloomberg, noting that the swoon amounted to the worst five-day period for the health insurance industry in eight years. More broadly, health care is the stock market’s worst-performing sector this year.

Wall Street analysts said the decline reflects investor concern about what Medicare-for-All would mean for insurers if Sanders, a Vermont independent who trails only Joe Biden in early polling for next year’s Democratic primaries, were to be elected: virtual extinction. His plan would essentially replace all private health insurance with a single-payer system.

In the earnings call, Wichmann asserted that universal health care “could be substantially reached through existing public and private platforms.” That’s unlikely to appease Sanders. He has described the effort to adopt Medicare for All as nothing short of a “struggle for the soul of who we are as a nation,” most recently stumping for the idea on Monday at a Fox News town hall in Bethlehem, Pennsylvania.

Although health care investors seem spooked by the focus on Medicare for All, some analysts point out that the sector remains in fine fettle.

“We believe the sell-off in health care services is overblown, as concerns around ‘Medicare For All,’ the pharma regulatory environment and persistent ACA noise have triggered panic selling across the universe,” Oppenheimer analysts said in a research note that advised clients to capitalize on the dip to scoop up some blue-chip stocks on the cheap.

Other market watchers also remain skeptical about Medicare-for-All’s political prospects. Height Securities analysts note that, even if Sanders were elected president, Democrats would likely have to take the Senate to advance his signature policy.

That could augur a rebound in health stocks, but the ongoing debate is likely to remain a cloud over the industry leading into 2020.