David Blitzer — a stock-market indexing icon — is retiring at the end of August, according to S&P Dow Jones Indices, after nearly a quarter-century of picking the stocks that make up America’s most closely followed equity benchmarks.

Blitzer, who has overseen the composition of the S&P 500 index SPX, +0.00% and the 123-year-old Dow Jones Industrial Average DJIA, -0.30% for years, is considered a luminary among those who follow indexing — the selection of individual stocks (or other assets) in a benchmark.

The 70-year-old has led the S&P’s stock committee that has helped to determine the makeup of S&P 500 and Dow, with some $10 trillion in exchange-traded funds, or ETFs, pegged to the S&P 500, allowing mom- and-pop investors to cheaply and efficiently gain exposure to the stock market in popular products like the SPDR S&P 500 ETF Trust SPY, +0.05% and the SPDR Dow Jones Industrial Average ETF Trust DIA, -0.27%

Exchange-traded fund focused website ETF.com in a 2015 Q&A referred to Blitzer as one of the “legends of indexing.” And a 2017 Wall Street Journal article called him the “gatekeeper of the S&P 500.”

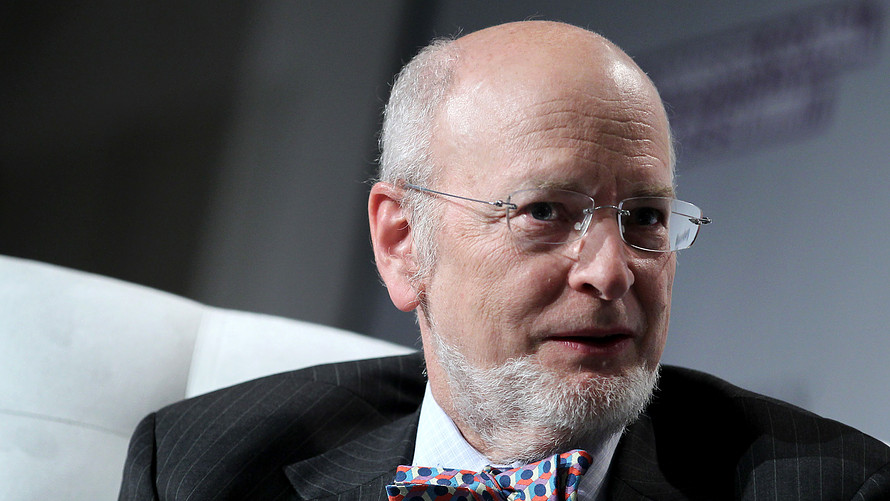

Average folks, however, may have trouble ID’ing the financial professional, known for his signature bow tie, in a lineup of Wall Street’s Who’s Who.

Blitzer acknowledged as much to MarketWatch in a phone interview on Tuesday, saying that he’s heard the “legend” characterization bandied about in reference to his spot in the investing pantheon, along with the likes of Vanguard founder Jack Bogle, the father of ETFs and passive investing.

“I’m not quite sure what it means to be a legend,” he said. “To be mentioned as somewhat in the same sentence [as Jack Bogle] is very nice and much appreciated and a credit to everyone at S&P,” he said.

The indexing pro’s decision to step down comes as passive investing, buying ETFs or fund products that track indexes, has exploded. In 2017, index funds accounted for 35% of total U.S. fund assets, versus 15% a decade earlier. In 2017 the net flow of new investment assets into index funds was $692 billion, while the net flow into actively managed funds was negative — minus $7 billion.

Blitzer has been the maestro of the construction of these indexes, underlined by recent changes to the Dow industrials.

On Tuesday, materials-science company Dow Inc. DOW, +5.15% made its debut among the Dow’s 30 components as it completed a spinoff from DowDuPont DWDP, -0.27% Dow Inc. is among the smallest companies by market value, at $42 billion, within the price-weighted Dow industrials (only Travelers Cos. Inc. TRV, -0.88% is smaller at $36 billion). Blitzer said there were a number of factors in deciding to keep Dow Inc. within the blue-chip index.

“We looked at handling this process in a way that is not disruptive to the index and not disruptive to the market,” he told MarketWatch. He said ensuring that the Dow index doesn’t hew too far from its roots as an industrials benchmark also was a factor in the S&P stock committee’s decision making, with few materials and industrials entities that might meet the criteria as apt replacement for Dow Inc.

“That is definitely a consideration. The Dow traditionally was industrials with a capital ‘I’,” he said.

“We respect that it has changed over time…the idea that we should keep representation of traditional industrials companies is definitely a consideration,” Blitzer said. “It is always a balancing act,” he said.

Blitzer first joined McGraw Hill Companies, (which became S&P Global) in 1980 as a corporate economist. In 1982, he was appointed Standard & Poor’s chief economist, and later in 1989, he joined the index committee, becoming its chairman in 1995.

Looking ahead, Blitzer said investors are faced with a number of uncertainties that could stoke fresh stock-market volatility. “I think what we’re looking at a lot of unknowns and the future gotchas,” he said.

The Dow has gained 12.2% so far in 2019, the S&P 500 has risen by 14.3% and the Nasdaq Composite Index COMP, +0.25% boasts a handsome return of 18.2% in the first four months of the year.

“The volatility has been intriguing,” Blitzer said, referring to the bumps along the way, including late-2018 trade that culminated in the worst Christmas Eve plunge for stocks on record.

Still, Blitzer, a champion of long-term investing over market timing, said the biggest risk for investors is that they will get spooked by a big downturn.

The big risk is that “the market goes down — and it will — and they get scared off and it goes down. and they sell and they don’t come back,” he said.

For his part, Blitzer is holding on to S&P 500 ETFs, though he won’t say which brand. His business has dictated that he cannot own individual stocks.

As for his decadeslong career: “Looking back, [I have] no complaints, so far, it’s been wonderful and I’m willing to bet the next stage will be good,” he Blitzer said.

Blitzer’s retirement, he said, was finally decided at the end of last year after consulting with his family, which consists of his wife, a son a daughter and one grandchild.