History signals March will be a positive month for the stock market.

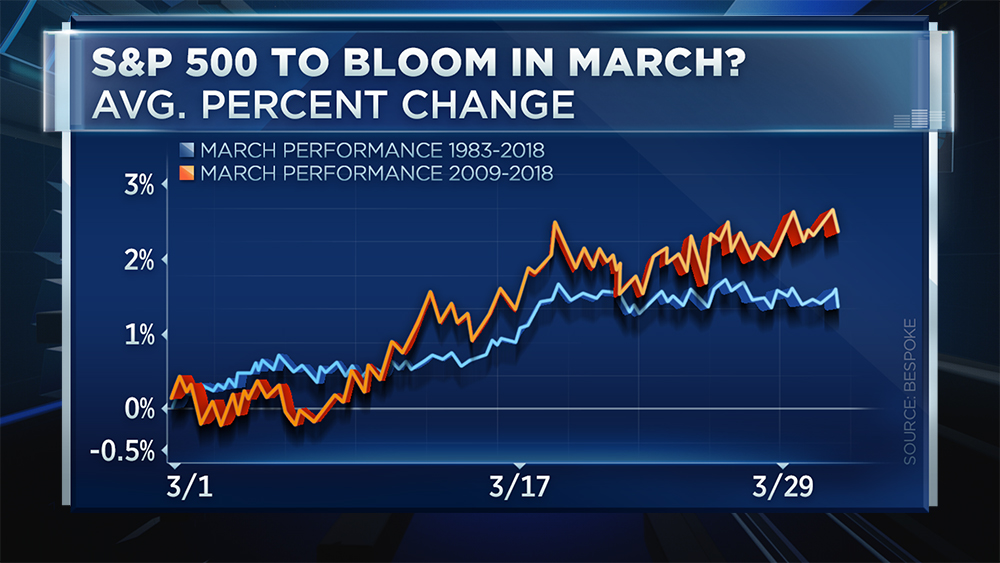

According to Bespoke co-founder Paul Hickey, the S&P 500 gained an average of 2.39 percent between 2009 and 2018, the current bull market.

“It tends to start off on a relatively quiet note — flat — and the bulk of the gains have historically come at the middle of the month,” he said Friday on CNBC’s “Trading Nation. ”

Hickey builds his bullish case from a chart showing how the S&P 500 typically performs during March.

Going back further to 1983, he finds those gains are 1.35 percent.

“When you see a 10 percent gain or more in the S&P 500 in the first two months of the year … March was positive five out of six of those times,” said Hickey, who notes the March-to-April period is seasonally the strongest period of the year.

The S&P 500 has rallied almost 12 percent since the beginning of the year, and it’s up more than 19 percent since the December low. Plus, he adds, market breadth remains off-the-charts strong.

However, that doesn’t mean stocks aren’t vulnerable to some near-term trouble.

Hickey is detecting overbought conditions in the market. But with negative analyst sentiment as a contrary indicator, an expected U.S.-China trade deal and a more dovish Federal Reserve, he says any market turbulence would be short-lived.

“When the Fed was pretty hawkish in October through early December it was, you know, very nasty to the market. And then when the Fed started to turn, so did the market,” Hickey said. “As long as the Fed and the market perceives the Fed as being on hold, I think the market can continue to go.”