Nvidia stock fell as much as 19 percent Thursday after the company reported earnings for the third quarter of its 2019 fiscal year, which ended on Oct. 28.

Here’s how the company did:

- Earnings: $1.84 per share, excluding certain items, vs. $1.71 per share as expected by analysts, according to Refinitiv.

- Revenue: $3.18 billion, vs. $3.24 billion as expected by analysts, according to Refinitiv.

With respect to guidance, Nvidia said it’s expecting $2.70 billion in revenue in the fiscal fourth quarter, plus us minus 2 percent, excluding certain items. That’s below the Refinitiv consensus estimate of $3.40 billion.

Overall, in the fiscal third quarter, Nvidia’s revenue rose 21 percent year over year, according to its earnings statement.

In its fiscal second-quarter earnings, the chipmaker fell short of analyst expectations on guidance despite beating on earnings and revenue estimates. The company’s cryptocurrency mining products suffered a hefty decline in that quarter, and the trend continued in the fiscal third quarter.

It has become less profitable to use graphics processing units, or GPUs, for mining, according to a recent analysis by Susquehanna. To mine cryptocurrency, computers compete to solve complex math problems in exchange for a specific amount of bitcoin or ethereum. But as both currencies have sunk in value, so too has this segment of revenue for Nvidia.

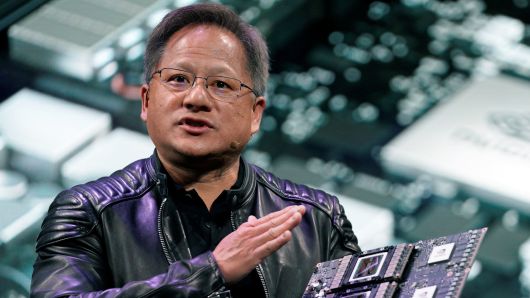

“Our near-term results reflect excess channel inventory post the crypto-currency boom, which will be corrected,” Nvidia CEO Jensen Huang is quoted as saying in a Thursday press release. In the fiscal third quarter Nvidia’s revenue from original equipment manufacturers and intellectual property totaled $148 million, which was down 23 percent year over year but above the FactSet consensus estimate of $102 million. Nvidia chocked up the decline to “the absence of cryptocurrency mining” in its earnings statement.

In the quarter Nvidia had a $57 million charge related to older products because of the decrease in demand for cryptocurrency mining.

“Our Q4 outlook for gaming reflects very little shipment in the midrange Pascal segment to allow channel inventory to normalize,” Nvidia’s chief financial officer, Colette Kress, told analysts on a conference call after the company announced its results.

It will take one to two quarters to go through the extra inventory, Huang said on the call.

“This is surely a setback, and I wish we had seen it earlier,” he said.

Inventory issues also affect other brands, Huang said. AMD stock fell 5 percent in extended trading on Thursday.

Nvidia’s gaming business segment generated $1.76 billion in revenue in the quarter, below the $1.89 billion FactSet consensus estimate.

Nvidia’s data center segment came in at $792 million in revenue, lower than the $821 million estimate.

Revenue for the company’s professional visualization business segment was $305 million, surpassing the $284 million estimate.

Nvidia, like most other tech stocks, was hit hard in October, which was the worst month for the Nasdaq Composite Index since 2008. The stock is now up 4 percent since the beginning of the year.